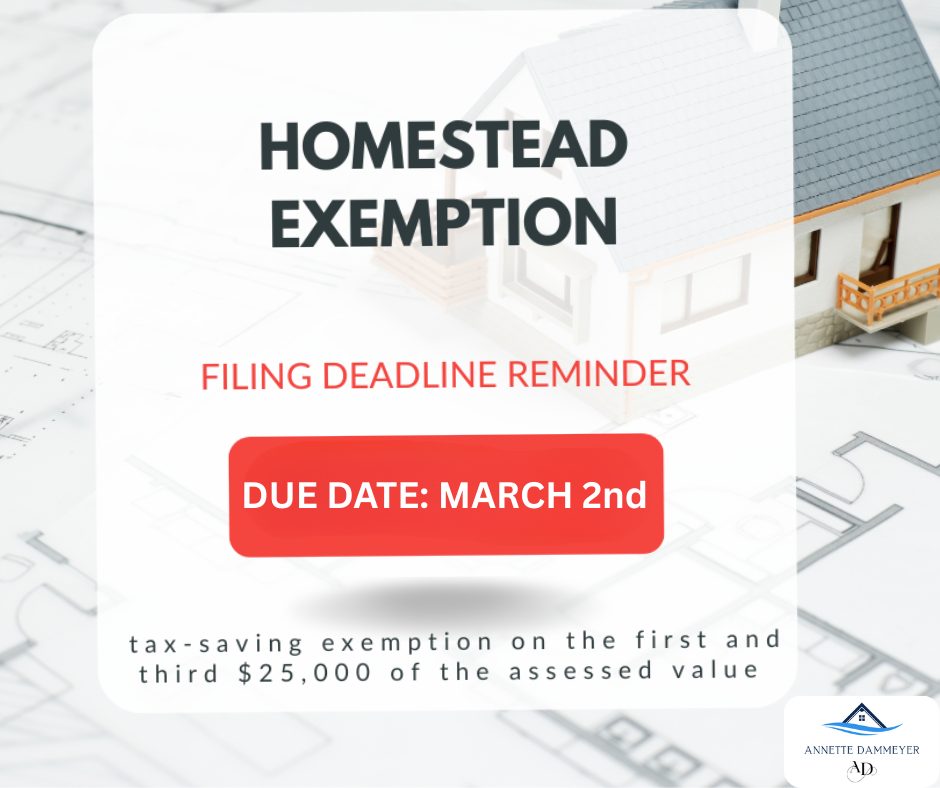

📌 🟥 Deadline to File Your 2026 Homestead Exemption

-

Timely Filing: March 2, 2026

-

Late Filing Window: Until September 18, 2026 (THIS IS THE FINAL DEADLINE)

✅ Who Qualifies?

- You must own and occupy your property as your permanent residence as of January 1, 2026.

- Florida residents are eligible for up to $50,000 in assessed value exemption:

- First $25,000 applies to all property taxes

- Additional $25,000 applies to non-school taxes

🧾 Required Documents to File

Be prepared to submit the following with your application:

- Proof of Ownership: Deed, closing statement, or proprietary lease

- Proof of Permanent Residency: As of January 1 – your primary residence

- Identification:

- Florida Driver’s License or ID

- Valid Voter Registration or alternative Address Declaration

- For non-citizens: documents to establish permanent residency

- Additional documentation (if requested): Social Security number(s), previous state ID, proof of vehicle registration, utility bills, etc.

🌐 How to File

File online through the Broward County Property Appraiser’s website:

🔗 https://web.bcpa.net

Alternatively, file in person or by mail at the Property Appraiser’s office in downtown Fort Lauderdale. Be sure to bring all required documentation or submit the scanned copies when filing online.

⚠️ Why It’s Critical

- ☑️ Immediate Savings on your property tax bill

- 📉 Long-Term Protection under the “Save Our Homes” cap (limits annual assessed value increases to 3%)

- 💡 You must apply by March 2 for timely consideration — late filings accepted only through September 18

🔔 Act Now – Don’t Miss Out!

Ensure peace of mind and maximize your tax savings. If you’ve recently closed on a home in 2025, act quickly—your timely filing window is closing soon.

📞 For questions, contact the Broward County Property Appraiser at (954) 357-6830 or email mmartykiar@bcpa.net

📌 Reminder:

- 🟥 Timely deadline: March 2, 2026

- 🟥 Final deadline (late filing only): September 18, 2026

Secure your financial benefit today! 💸

Filing for your Florida Homestead Exemption is a smart step toward protecting your investment and saving on property taxes. As your local real estate expert, I’m always here to help—whether you have questions about exemptions, buying or selling a home, or anything in between. Don’t hesitate to reach out—I’m just a call or message away and always happy to be a resource for you!

CONTACT ANNETTE

Let’s start working together!

Annette Dammeyer, REALTOR®, ABR®, AHWD®

Coldwell Banker Realty

901 E Las Olas Blvd STE 101, Fort Lauderdale, FL 33301

808.747.3686

SL 3535792

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link