🏡 Navigating Home Insurance in Southeast Florida: What Every Homeowner Needs to Know

As a local real estate professional in South Florida’s waterfront and lifestyle-driven communities, I know firsthand how confusing—and crucial—home insurance can be. With recent shifts in the market, including rate reductions from select private insurers (excluding Citizens), now is the time to get informed and empowered.

Let’s break down the essentials so you can protect your investment with confidence.

📉 Positive Trends: Some Insurers Are Lowering Rates

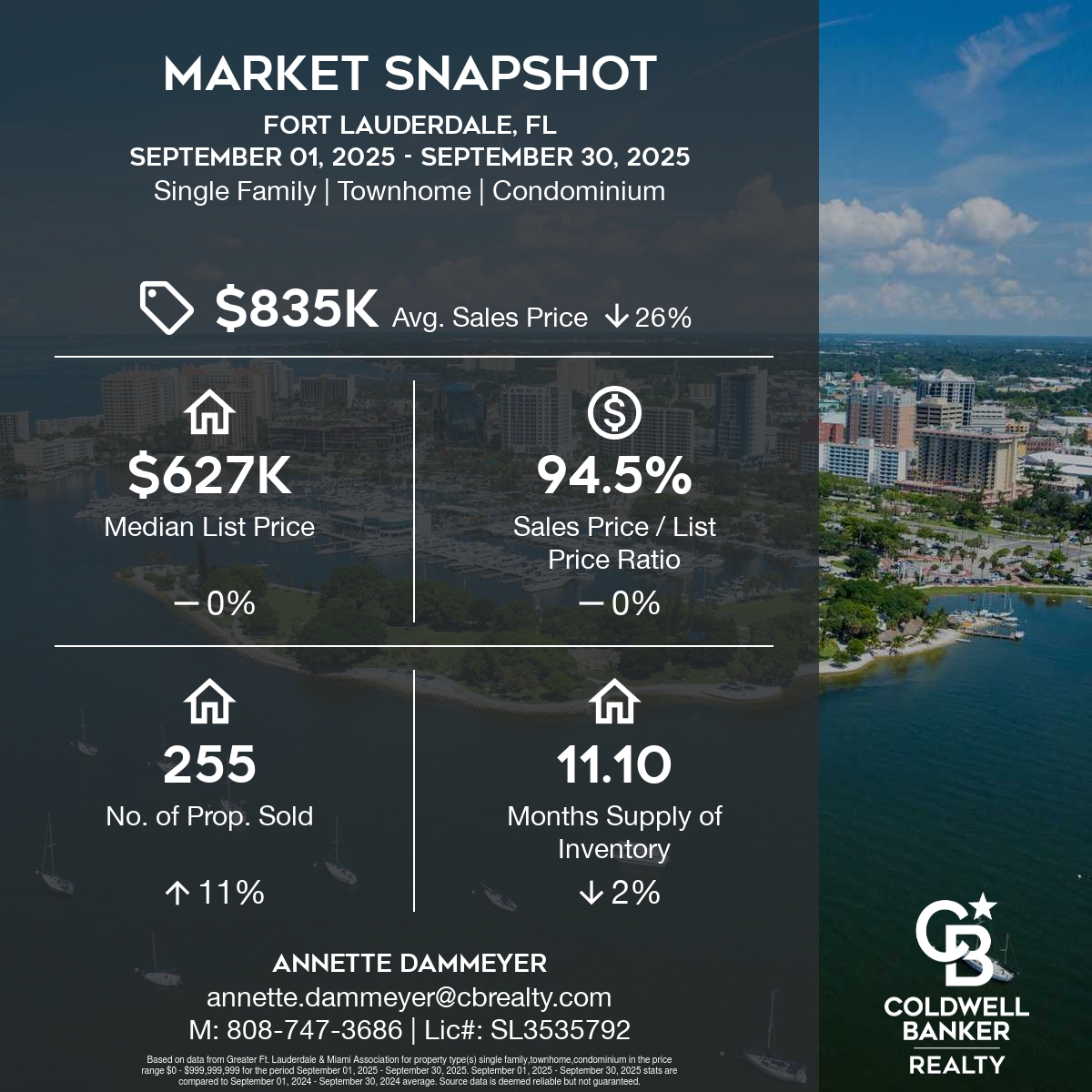

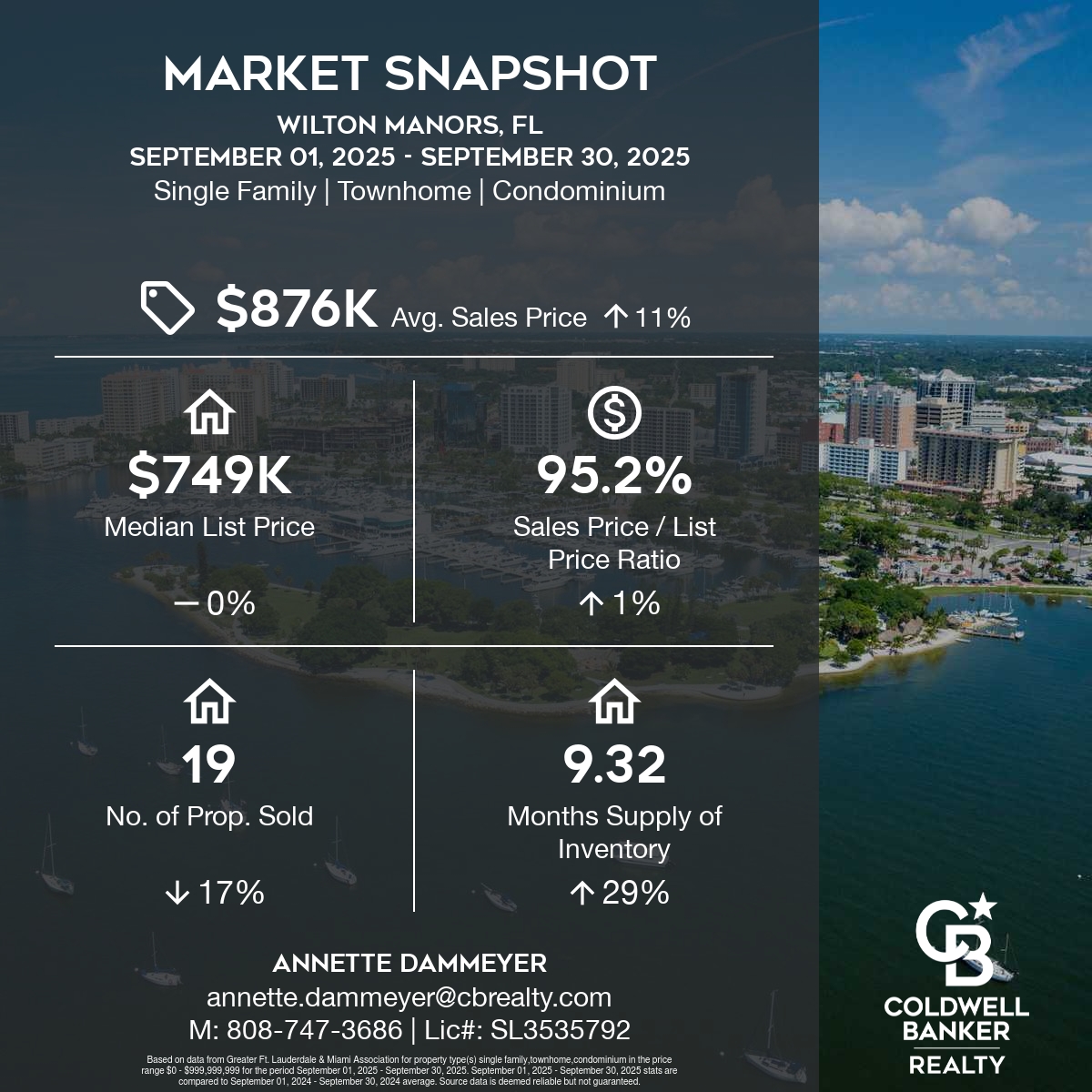

After years of skyrocketing premiums, private insurers are beginning to file for rate decreases in 2025. This is a welcome shift, especially for homeowners in Fort Lauderdale, Hollywood, and surrounding areas who’ve been navigating a volatile insurance market.

Note: Citizens Insurance is not included in these reductions, but its policy count is dropping as private carriers re-enter the market.

🆕 New Home Insurance Providers Entering the SE Florida Market

Thanks to recent legislative reforms aimed at curbing litigation abuse and stabilizing the insurance market, several new private insurers have entered Florida in the past year. These companies are offering competitive rates and broader coverage options, especially in areas like Hollywood, Fort Lauderdale, and Dania Beach.

✨ Notable New Entrants (2024–2025)

Here are some of the most promising new providers now serving SE Florida:

- Viceroy Preferred Insurance

Focused on personalized property coverage with competitive premiums.

- Vision Insurance Exchange

Offers flexible policy structures and is gaining traction for its customer-first approach.

- Tailrow Insurance Company

Specializes in homeowners insurance with a niche focus on Florida’s unique risks.

- Mainsail Insurance Company

Provides bundled options (home, auto, commercial) for convenience and savings.

- Orange Insurance Exchange

A Florida-based startup offering innovative, locally tailored solutions.

- Trident Reciprocal Exchange

One of the newer carriers authorized to operate statewide.

- Ovation Home Insurance Exchange

Known for tech-forward underwriting and streamlined claims processing.

These companies are helping to restore competition and lower premiums—a welcome shift for homeowners who’ve faced steep rate hikes in recent years.

🛡️ What Is Citizens Insurance—and Why Are They Depopulating?

Citizens Property Insurance Corporation is Florida’s state-backed insurer of last resort. It was created to provide coverage when private insurers won’t, especially in high-risk areas.

Why It Matters:

- Citizens grew rapidly during the insurance crisis, becoming the largest insurer in Florida.

- However, it’s not designed to be a long-term solution—its rates are often capped and don’t reflect actual market risk.

- If Citizens faces massive claims (e.g., after a hurricane), all Florida policyholders may be assessed fees to cover shortfalls.

🚪 Depopulation Explained:

- As private insurers return to the market, Citizens is encouraging policyholders to switch to private carriers.

- This reduces Citizens’ exposure and helps stabilize the overall insurance ecosystem.

- Homeowners may receive offers from private insurers to take over their Citizens policy—often with better coverage or pricing.

🧮 Understanding Replacement Cost vs. Purchase Price

Insurance premiums are based on replacement cost, not market value.

- Replacement Cost: What it would cost to rebuild your home today using current labor and materials.

- Purchase Price: Influenced by location, demand, and market trends.

💡 Example: A home purchased for $500K may cost $600K to rebuild—your insurance is based on the latter.

🌤️ Best Time to Shop for Insurance: Avoid Hurricane Season

Timing matters.

- Ideal Window: Late fall through early spring (November–April)

- Why: During hurricane season (June–November), insurers often restrict new policies or raise rates due to increased risk.

📍 Zip Code Eligibility Can Change Fast—Act Quickly

Insurance companies frequently open and close zip codes based on risk models.

- If you find a favorable quote, bind it immediately.

- If your home purchase falls through, you can cancel the policy—no harm done.

🏠 Home Age Matters—Even If It’s Renovated

Insurance rates are heavily influenced by the year the home was built, not when it was renovated.

- A renovated 1950s home is still considered a 1950s home.

- To be considered “new construction,” the property must be:

- Completely torn down (no walls left)

- Rebuilt with permits

- Issued a new Certificate of Occupancy

🛠️ Lower Your Premium with a 4-Point Inspection

A 4-point inspection evaluates key systems in older homes and can help reduce your premium if deficiencies are corrected.

What’s Included:

1. 🏚️ Roof

- Inspectors look for:

- Age, condition, leaks, and remaining life

- Typical lifespans:

- Flat: 10–20 years

- Shingle: 15–30 years

- Tile: 25–50 years

- Insurers require at least 5 years of life left (5 years beyond the closing date).

🚫 The Problem with Roof Coatings in SE Florida Insurance

While roof coatings (like acrylic, silicone, or elastomeric sealants) can help protect and extend the life of a roof by sealing cracks and improving water resistance, insurance providers in Southeast Florida typically do not recognize coatings as valid roof replacements.

Why It Matters:

- Coating ≠ Replacement: Insurers view coatings as cosmetic or temporary fixes—not structural upgrades.

- Coverage Denial Risk: If a roof is coated instead of replaced, it may be deemed ineligible for coverage, especially by Citizens Insurance and many private carriers.

- Age Still Counts: Even with a fresh coating, the roof’s original age remains unchanged in the eyes of insurers.

Citizens Insurance explicitly states that using coatings in place of full replacement makes the property ineligible for coverage.

🔍 Bottom Line for Homeowners:

If you’re trying to insure or sell a home with a coated roof, be prepared for:

- Higher premiums

- Limited carrier options

- Possible denial of coverage

For insurance purposes, a roof must be structurally replaced—not just cosmetically refreshed—to be considered compliant.

2. ⚡ Electrical

- Inspectors check:

- Panel type, wiring, grounding, and safety

- Panels often rejected:

- Federal Pacific (FPE)

- Zinsco

- Challenger

- Sylvania (certain models)

- Stab Lok

3. ❄️ HVAC & Water Heater

- Life expectancies:

- AC/HVAC: 10–15 years

- Water Heater: 8–12 years

- Tip: Water-related claims are the #1 source of insurance payouts—keep these systems updated.

4. 🚰 Plumbing

- Inspectors assess:

- Pipe material, leaks, water pressure

- Preferred pipes:

- Problem pipes:

- Polybutylene (gray plastic, often stamped “PB2110”)

- These must be replaced to avoid coverage denial.

🌬️ Wind Mitigation Inspection: Save Big with Impact Protection

A wind mitigation inspection can significantly reduce your premium.

- What it checks:

- Roof shape and attachment

- Impact-rated windows and doors

- Shutters and garage door reinforcement

- All windows and doors must be impact

- 🪟 Partial Impact Protection: How It Affects Insurance Premiums in SE Florida

In Southeast Florida, insurance companies reward homes with full impact protection—meaning all exterior openings (windows, doors, skylights, and garage doors) must be impact-rated or have approved shutters.

🔍 What Happens If Only Some Are Impact?

- No Full Credit: If only some windows or doors are impact-rated, the home typically does not qualify for the highest wind mitigation discounts.

- Tiered Discounts: Florida law allows insurers to offer tiered credits, but partial protection often falls into a lower category—sometimes resulting in minimal or no premium reduction.

- Uniform Mitigation Verification Form: Inspectors must document each opening. If any are unprotected, the form reflects that, and insurers adjust the discount accordingly.

Example: A home with 80% impact windows but a non-impact front door and garage door may still be considered unprotected under wind mitigation standards.

🏷️ Why Full Impact Matters

- Windstorm coverage is a major portion of Florida premiums—often 60–70% of the total.

- Homes with full impact protection can save 10–45% on that portion of the premium.

- Partial protection may only qualify for basic credits, or none at all, depending on the carrier.

⚠️ Pro Tip: Never Remove Impact Labels

To qualify for discounts, insurers require:

- Visible labels with product approval codes (e.g., Miami-Dade= NOA or ASTM standards, Broward= TAS/Product Approval #)

- Documentation from the manufacturer or installer

Removing labels can make it impossible to verify compliance—even if the product is impact-rated.

🌊 Flood Insurance: Always a Smart Move in SE Florida

Flooding isn’t just a coastal issue—it can happen anywhere.

- Covers:

- Water damage from rising water, storm surge, and seepage

- Flood insurance rates are not decreasing and remain essential.

- Flood zones:

- Zone A & V: Mandatory insurance if you have a mortgage

- Zone X: Optional but recommended (not optional for Citizens)

💡 Even if you’re in Zone X, a low-cost policy can protect you from unexpected events.

💬 Final Thoughts from Your Local Real Estate Ally

I hope this guide helps you feel more confident navigating home insurance in Southeast Florida. Whether you’re buying, selling, or simply reviewing your current policy, knowledge is power—and protection.

If you’d like trusted referrals to local insurance providers or want to review your own policy, I’m happy to connect you with professionals who understand our unique market.

Let’s keep your home—and peace of mind—secure.

Your SE Florida Real Estate Guide & Advocate

Let’s start working together!

Annette Dammeyer, REALTOR®, ABR®, AHWD®

Coldwell Banker Realty

901 E Las Olas Blvd STE 101, Fort Lauderdale, FL 33301

808.747.3686

Annette.Dammeyer@cbrealty.com

www.AnnetteDammeyer.com

SL 3535792

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link