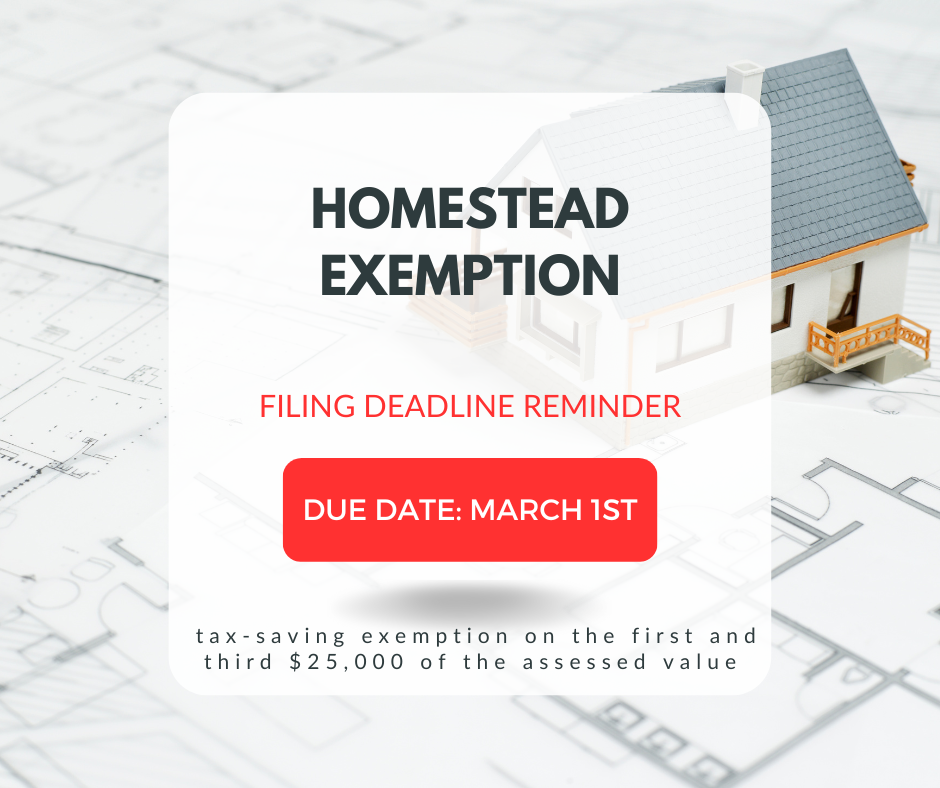

FLORIDA HOMESTEAD EXEMPTION

Due Date is March 1st, 2024

All legal Florida residents are eligible for a Homestead Exemption on their homes, condominiums, co-op apartments, and certain mobile home lots if they qualify. The Florida Constitution provides this tax-saving exemption on the first and third $25,000 of the assessed value of an owner/occupied residence. While a complicated formula is used to explain this — as the additional $25,000 only applies to the non-schools portion of your tax bill in annual tax savings for all homes with a value of $75,000 or higher. Savings depend upon your city’s millage rate

You are entitled to a Homestead Exemption if, as of January 1st, you have made the property your permanent home or the permanent home of a person who is legally or naturally dependent on you. By law, January 1 of each year is the date on which permanent residence is determined.

Broward County:

For additional information on Homestead and Other Exemptions and what you will need to apply for the exemption:

Marty Kiar, Broward County Property Appraiser

Online Homestead Application 2024

- Florida Tax Oversight

- The Property Tax System

- Contact a County Official

I love keeping my community informed! Please reach out to me for any real estate assistance you may need. I will continue to serve my clients with experience, integrity and dedication.

Annette Dammeyer, REALTOR

Coldwell Banker Realty

901 E Las Olas Blvd STE 101, Fort Lauderdale, FL 33301

808.747.3686

SL 3535792

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link