Navigating Waterfront Home Purchases in Southeast Florida: A Comprehensive Guide for Boating Enthusiasts

As a seasoned real estate professional specializing in waterfront properties in Southeast Florida, I understand the unique considerations that boating enthusiasts must address when purchasing a home. Beyond the allure of scenic views, it’s essential to ensure that the property meets your specific boating needs. Here’s a list of considerations to help you make an informed decision.

1. Assess Dock Dimensions and Setbacks

Before finalizing a purchase, verify that the property’s dock can accommodate your vessel’s length and beam. Florida regulations often mandate setbacks from neighboring property lines to ensure safety and environmental compliance. It’s crucial to consult local zoning laws to determine specific setback requirements for the area you’re considering. The linear length of the waterfront must be able to accommodate the total length of the vessel plus the setback requirement.

-

Setbacks:Docks are generally setback 5 feet from the property line, but in some cases, 10 feet is required. This setback is calculated from the property line at the bow and stern sides of the vessel.

2. Evaluate Waterway Accessibility

Determine the property’s proximity to open waters, inlets, and the ocean. Consider the presence of fixed bridges along your intended route. Most fixed bridges over the Atlantic Intracoastal Waterway in Florida offer a vertical clearance of 65 feet above mean high water, except for the Julia Tuttle Causeway in Miami, which has a 56-foot clearance. Ensure that your vessel’s height, especially with antennas or towers, can safely pass under these structures at high tide.

3. Check Water Depth and Draft Compatibility

Assess the water depth at the property’s dock during both high and low tides. Ensure that the depth accommodates your boat’s draft to prevent grounding. A minimum depth of 3 feet at mean low water is often required for single-family docks. Consult tide charts and, if possible, conduct a depth survey to confirm suitability. In my experience, it is smart to ask the current property owner if the waterway has been previously dredged. This may indicate a need for dredging in the future.

4. Inspect Seawall Integrity

A sturdy seawall is vital for protecting your property from erosion and storm surges. Regular inspections are recommended, with experts advising annual checks in areas prone to severe weather. Look for signs of wear, such as cracks, rust stains, or soil erosion. Engage a professional to assess the seawall’s condition and determine if repairs or replacements are necessary. Click link for: Broward County Regional Standards for Seawalls & Flood Barriers

The new Miami-Dade County regional seawall ordinance mandates that all new seawalls must be constructed to a minimum elevation of 5.7 feet NAVD, or 4 feet NAVD if designed to support a future elevation of 5.7 NAVD, according to the City of Miami Beach – Rising Above. It also codifies that seawalls must be upgraded if the property undergoes new construction or substantial improvements, and establishes overtopping as a trigger for seawall elevation and maintenance requirements.

5. Verify Shore Power Availability

Ensure the dock is equipped with adequate shore power to meet your vessel’s electrical needs. This includes checking for appropriate voltage, amperage, and the condition of power pedestals. Proper shore power is essential for charging batteries, running onboard systems, and ensuring comfort during docked periods.

6. Confirm Channel Width and Navigability

The waterway leading to your dock should be wide enough to allow safe maneuvering without encroaching on neighboring properties. In Broward County, Florida, a 30% rule limits the width of a docked vessel to 30% of the canal’s width, measured from the recorded property line. Also, in canals or waterways 50 feet or less wide, fixed or floating docks can extend a maximum of 5 feet from the measurement reference line. Boats cannot be moored to or tied to a seawall or other mooring structure without the owner’s permission, except in cases of distress. Ensure that the channel’s width and depth are sufficient for your vessel’s size and handling characteristics.

7. Evaluate Dock Condition and Boat Lift Feasibility

Inspect the existing dock for structural integrity and maintenance. If you plan to install a boat lift, determine whether the current dock can support it or if extensive repairs are needed. Consult with marine contractors to assess feasibility and compliance with local regulations.

-

Constructing or installing docks, boat lifts, and other structures in waterways requires permits from the city engineer and building official.

8. Understand Wake Zone Regulations

If the property is located on the Intracoastal Waterway, be aware of designated wake zones. These areas require vessels to operate at idle speed to minimize wake, protecting both the shoreline and other vessels. Understanding these regulations is crucial for planning your boating activities. It is very common for waterfront home owners on the ICW to have boatlifts due to the waterway’s fluctuating water levels and potential for damage from weather and tides. A boat lift elevates the vessel above the waterline, protecting it from corrosion, algae buildup, and accidental impacts.

9. Know Flood Insurance Requirements

When purchasing a waterfront property in Southeast Florida, particularly in Broward and Miami-Dade Counties, it’s crucial to understand the implications of flood insurance:

-

Mandatory for High-Risk Zones: If your property is located in a Special Flood Hazard Area (SFHA) and you have a mortgage from a federally regulated or insured lender, flood insurance is required.

-

Recommended for All: Even if your property is outside of designated high-risk zones, flood insurance is strongly recommended. Flooding can occur due to heavy rains, storm surges, or infrastructure failures, and standard homeowners’ insurance policies typically do not cover flood damage.

-

30-Day Waiting Period: Be aware that there is typically a 30-day waiting period after purchasing flood insurance before the policy becomes effective.

-

Assessing Flood Risk: Use local resources to determine your property’s flood zone designation. Miami-Dade County provides flood zone maps, and Broward County offers an interactive flood map viewer.

Understanding and securing appropriate flood insurance is essential to protect your investment and ensure peace of mind in your waterfront home.

10. Familiarize Yourself with Local and State Regulations

Waterfront properties are subject to various local and state regulations. The Florida Department of Environmental Protection (FDEP) oversees environmental compliance, including dock construction and maintenance. Ensure that any modifications or additions to the property comply with FDEP guidelines and obtain necessary permits.

- If your property is within the BMSD (unincorporated area), you’ll need to contact the Broward County Zoning department directly. You can find their contact information and meeting schedule on their website.

- If your property is within a city or town (like Fort Lauderdale, Pompano Beach, etc.), you’ll need to contact the city or town’s zoning department.

Links to Consult Local Resources for Additional Information:

- Florida Department of Environmental Protection (FDEP)

- Broward County Zoning

- Miami-Dade County Zoning

- Dock Permitting in Florida

- Broward Safe Boating Guide (a VERY comprehensive guide on boating!)

Purchasing a waterfront home in Southeast Florida is a significant investment, especially for boating enthusiasts. By thoroughly evaluating dock specifications, waterway access, and structural integrity, you can ensure that your new home aligns with your maritime lifestyle. Partnering with a knowledgeable real estate professional can provide invaluable insights and guidance throughout this process.

Feel free to reach out if you have any questions or need assistance in finding the perfect waterfront property tailored to your boating needs.

CONTACT ANNETTE

Let’s start working together!

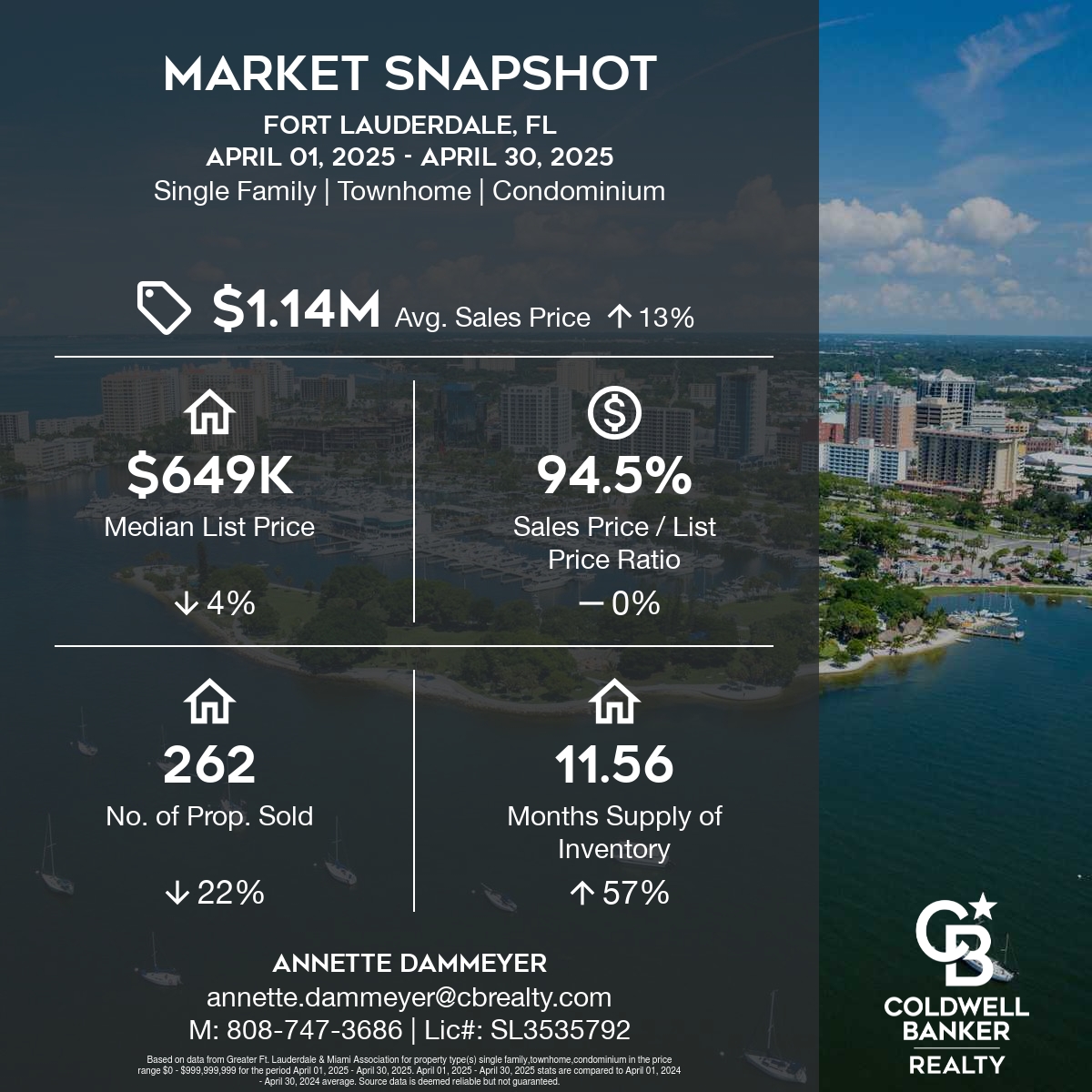

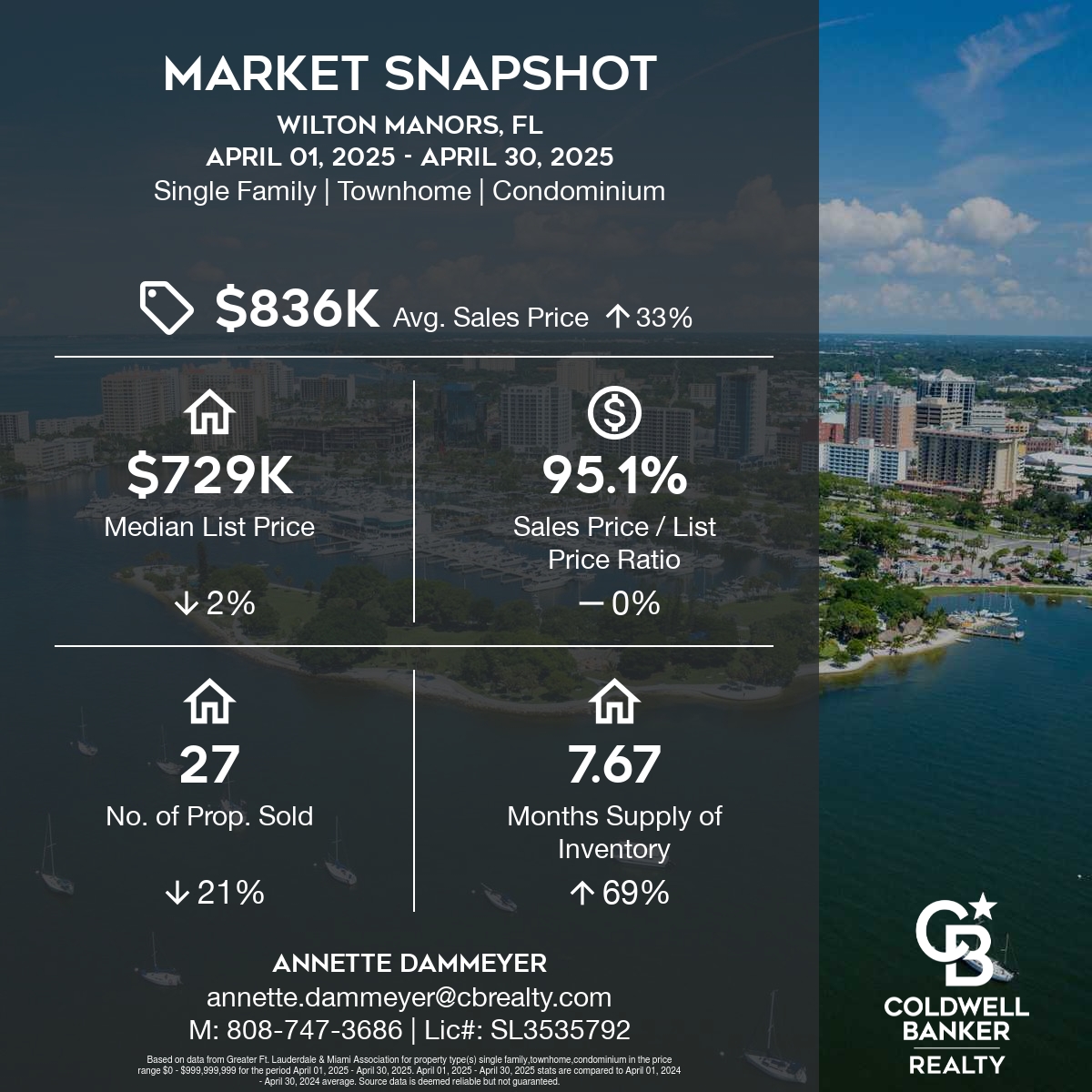

Annette Dammeyer, REALTOR®, ABR®, AHWD®

Coldwell Banker Realty

901 E Las Olas Blvd STE 101, Fort Lauderdale, FL 33301

808.747.3686

SL 3535792

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link