Understanding the NAR Settlement: What It Means for You as a Homebuyer or Seller

The recent National Association of Realtors (NAR) settlement has been making headlines, and as an experienced real estate professional, I want to ensure you’re well-informed about what this development means for you as a homebuyer or seller. The NAR settlement has sparked discussions about transparency, commission structures, and the overall dynamics of the real estate market. But what are the key facts, and how will they impact your real estate journey? Let’s delve into the essential details so you can navigate the market with confidence and clarity.

NAR has released fact sheets for both Homebuyers and Sellers.

HOMEBUYERS

SELLERS

Key Take-a-ways:

- Compensation remains negotiable

- Seller concessions to buyer and Seller offering compensation to the Buyer’s broker are still allowed

- Buyer Compensation will no longer be allowed to be included anywhere on an MLS (Multiple Listing Service)

- Buyers will be required to sign a written agreement before touring a home with a REALTOR® (virtually or in-person)

Representation:

Homebuyers and Sellers HAVE OPTIONS. As an experienced and knowledgeable real estate professional, I am here to help you understand these changes and how they may affect your home buying or selling process.

Whether you’re a first-time homebuyer looking to understand the new compensation disclosures or a seasoned seller wanting to list your home with the most effective marketing strategy, it’s crucial to stay informed and make educated decisions. The real estate market is evolving, and having a trusted guide by your side can make all the difference.

I invite you to reach out to me with any questions about the NAR settlement and how it specifically impacts your real estate transaction. Together, we can navigate these changes and ensure you achieve your real estate goals with confidence and success. Let’s discuss your unique needs and start your real estate journey today. I am here to help with integrity, transparency and dedication.

CONTACT ANNETTE

Let’s start working together!

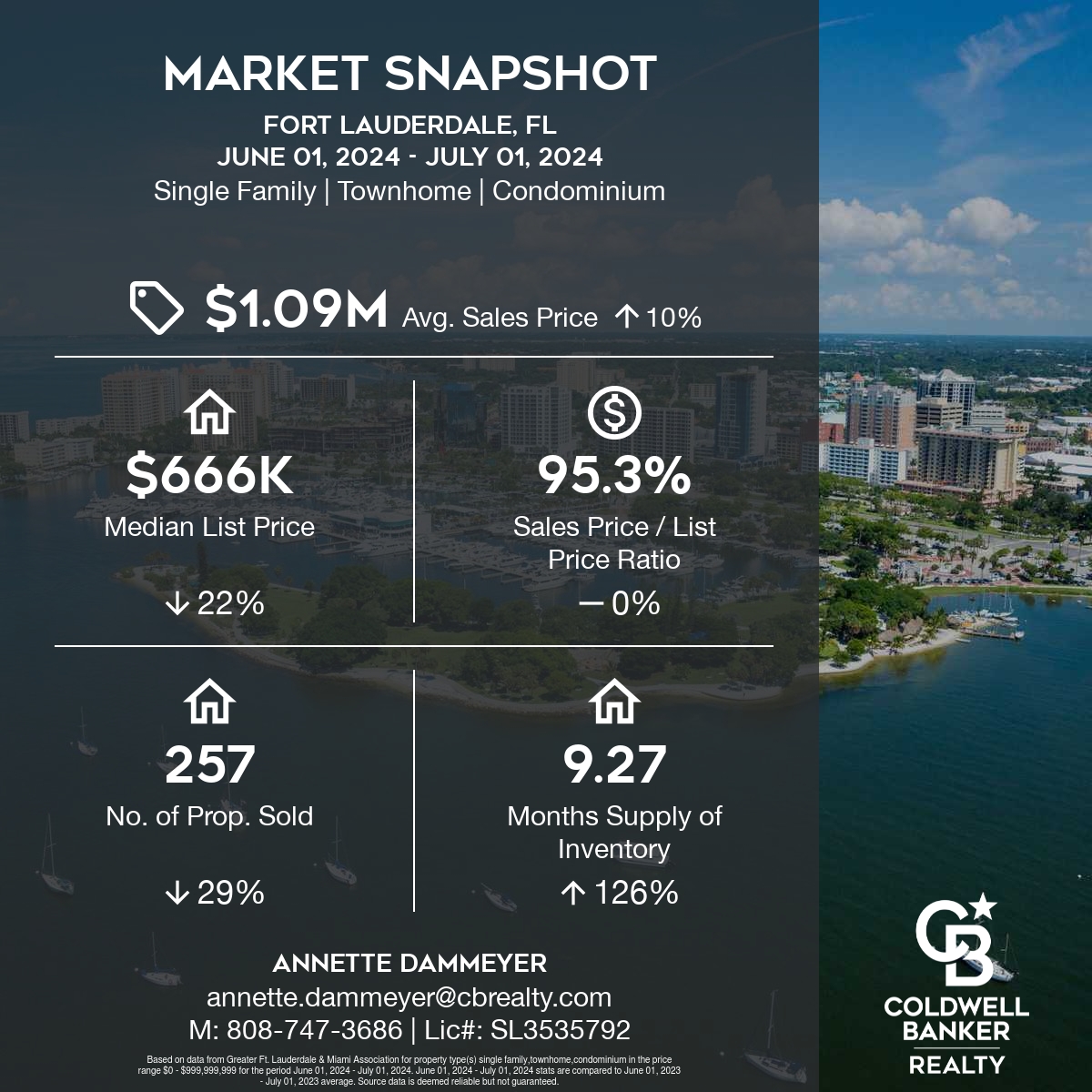

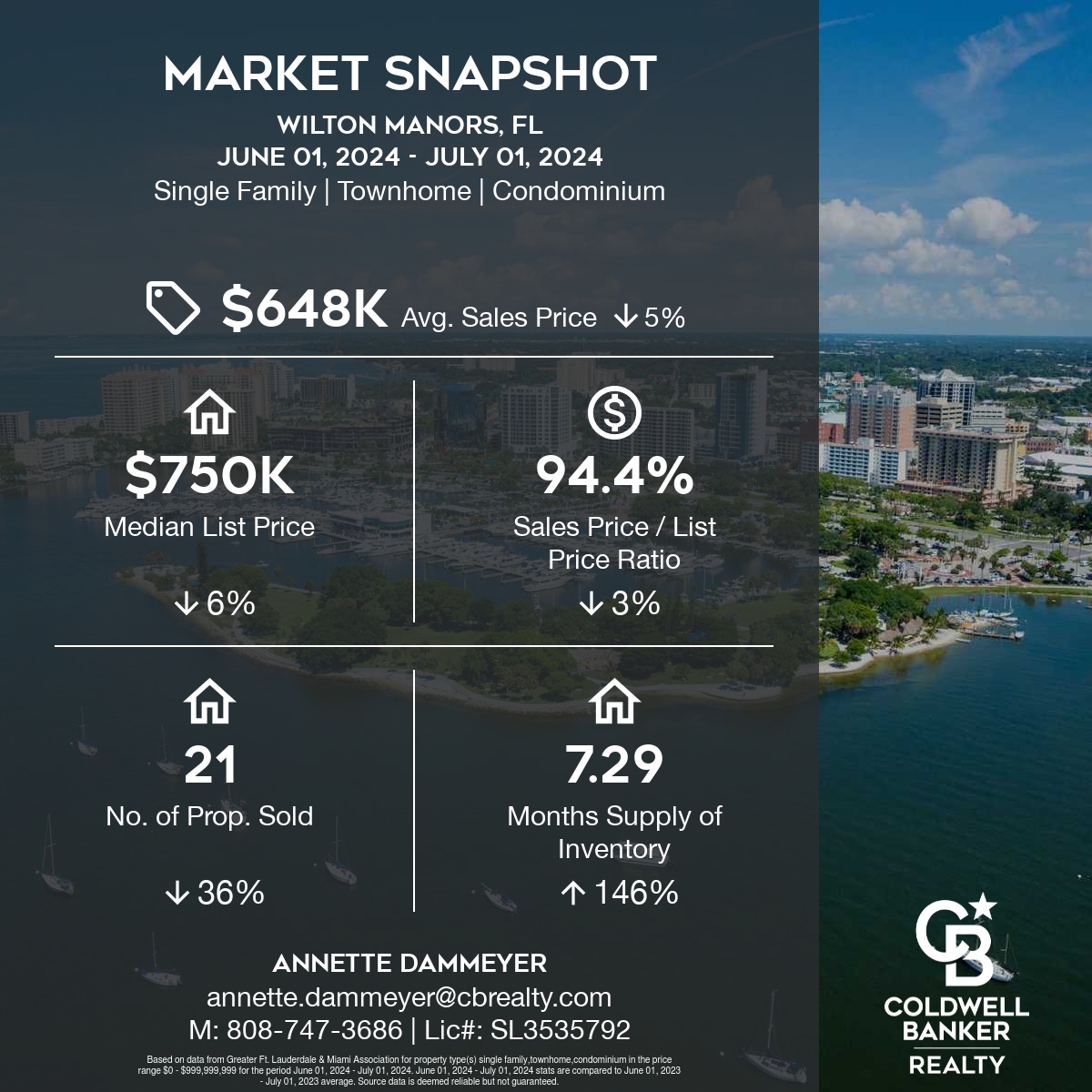

Annette Dammeyer, REALTOR

Coldwell Banker Realty

901 E Las Olas Blvd STE 101, Fort Lauderdale, FL 33301

808.747.3686

SL 3535792

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link